The Goods and Services Tax (GST), introduced on 1st July 2017, is India’s most significant indirect tax reform since Independence. By bringing together multiple central and state taxes into a single, unified system, GST created a common national market, reduced the cascading of taxes, simplified compliance, and improved transparency. Over eight years, GST has steadily evolved through rate rationalisation and digitalization, becoming the backbone of India’s indirect tax framework.

-

- Introduced: 1 July 2017

- Described as India’s most significant indirect tax reform since Independence.

- Unified multiple central and state taxes into One Nation, One Tax.

- Eliminated cascading of taxes and created a common national market.

- Over 8 years, GST evolved through rate rationalisation and digitalisation.

- Became the backbone of India’s indirect tax system.

Table of Contents

56th GST Council Meeting – Next-Gen GST Reforms

- Chaired by: Union Finance Minister Smt. Nirmala Sitharaman

- Announced in line with PM Narendra Modi’s Independence Day promise of a “Diwali gift”.

- Reforms aimed at:

- Common man

- Farmers

- MSMEs

- Women

- Youth

- Middle class families

- Effective from: 22 September 2025

- Exception:

- Cigarettes, chewing tobacco (zarda), unmanufactured tobacco, beedi

→ Existing GST + compensation cess continues

→ New rates later after cess loan + interest liabilities are cleared.

Core Reform – Simplified GST Structure

- Earlier slabs: 5%, 12%, 18%, 28%

- New structure: Two slabs only

- 5%

- 18%

- Special slab:

-

- 40% for luxury and sin goods:

- Pan masala

- Tobacco

- Aerated drinks

- High-end cars

- Yachts

- Private aircraft

- 40% for luxury and sin goods:

7 Pillars of Next-Gen GST Reforms

| Pillar | Focus |

| 1 | One Nation, One Tax strengthened |

| 2 | Expanded taxpayer base |

| 3 | Simplified 2-tier system (5% & 18%) |

| 4 | Rationalised duty structure |

| 5 | Faster refunds, digital filing, e-invoicing, AI risk detection |

| 6 | Empower MSMEs & manufacturers, fix inverted duty |

| 7 | Stronger state revenues through higher demand |

Compliance & Technology Reforms

- Simplified registration for small/low-risk businesses.

- 90% upfront provisional refunds for exporters.

- AI-driven risk detection.

- E-invoicing and digital compliance.

- Faster refund processing.

- Reduced filing burden.

Sector-Wise GST Changes

1. Food & Household Sector

| Item | Old | New |

| UHT milk, paneer (pre-packaged), Indian breads | Taxed | 0% |

| Soaps, shampoos, toothbrushes, toothpaste, tableware, bicycles | 12%/18% | 5% |

| Packaged namkeens, bhujia, sauces, pasta, chocolates, coffee, preserved meat | 12/18% | 5% |

| TVs (>32”), ACs, dishwashers | 28% | 18% |

2. Home Building & Materials

| Item | Old | New |

| Cement | 28% | 18% |

| Marble/travertine/granite blocks, sand-lime bricks | 12% | 5% |

| Bamboo flooring, wooden packing cases & pallets | 12% | 5% |

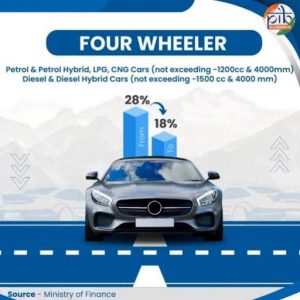

3. Automobile Sector

| Item | Old | New |

| Small cars, two-wheelers ≤350cc | 28% | 18% |

| Buses, trucks, three-wheelers, auto parts | 28% | 18% |

4. Agriculture & Farmers

| Item | Old | New |

| Tractors | 12% | 5% |

| Tractor tyres & parts | 18% | 5% |

| Harvesters, threshers, sprinklers, drip irrigation, poultry, beekeeping machines | 12% | 5% |

| Bio-pesticides, natural menthol | 12% | 5% |

Inverted duty on fertilizer inputs corrected →

Boost domestic production.

5. Service Sector

| Service | Old | New |

| Hotel stays ≤ Rs. 7,500/day | 12% | 5% |

| Gyms, salons, barbers, yoga | 18% | 5% |

6. Toys, Sports, Handicrafts, Textiles

| Item | Old | New |

| Man-made fibre | 18% | 5% |

| Man-made yarn | 12% | 5% |

| Handicraft idols, statues | 12% | 5% |

| Paintings, sculptures | 12% | 5% |

| Wooden/metal/textile dolls & toys | 12% | 5% |

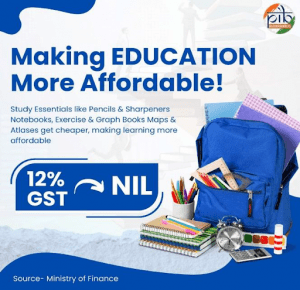

7. Education Sector

| Item | Old | New |

| Exercise books, erasers, pencils, crayons, sharpeners | Taxed | 0% |

| Geometry boxes, school cartons, trays | 12% | 5% |

8. Medical Sector

| Item | Old | New |

| 33 life-saving drugs, diagnostic kits | 12% | 0% |

| Ayurveda, Unani, Homoeopathy medicines | 12% | 5% |

| Spectacles, goggles | 28% | 5% |

| Medical oxygen, thermometers, surgical instruments | 12–18% | 5% |

| Medical, dental, veterinary devices | 18% | 5% |

9. Insurance

- GST exemption on:

- Life insurance

- Health insurance

- Floater plans

- Senior citizen policies

- Supports Mission Insurance for All by 2047.

Benefits of Next-Gen GST

- Lower prices → higher demand → industrial growth.

- Simpler rates → fewer disputes.

- Wider tax base → higher revenues.

- MSME cost reduction.

- Domestic manufacturing boost.

- Social protection through medicine & insurance exemptions.

Pre-GST Problems (VAT Era)

- Different tax rates across states.

- Entry taxes, multiple levies.

- Weak input tax credit.

- Double taxation (VAT + Service tax).

- Complex audits, penalties, returns.

Road to GST

The Road to GST: Challenges and Milestones

- Before the launch of the Goods and Services Tax (GST), India’s indirect tax system was highly fragmented. Every state followed its own tax rates, levies, and procedures, making trade across India complicated and compliance-heavy. Businesses often faced overlapping taxes, inconsistent rules, and limited credit for inputs.

Problems with the Pre-GST Era (VAT system)

- No uniform tax rates across states; additional levies like entry tax raised costs.

- Different rules for returns, audits, and penalties created confusion.

- Weak input tax credit provisions allowed misuse and tax evasion.

- Double taxation (VAT plus service tax) increased the burden on both businesses and consumers. To overcome these challenges, GST was conceived as a unified national tax system. The idea of GST was first proposed in 2000 with an Empowered Committee of State Finance Ministers set up to study sales tax reforms.

- Taking this idea forward and with extensive consensus building among states, the 101st Constitutional Amendment Act was passed and ratified in 2016, paving the way for GST.

GST was formally rolled out at midnight on 1st July 2017, hailed as a “path breaking legislation for New India.”

Why GST is a Milestone

- Subsumed 17 different taxes and 13 cesses into one unified tax.

- Eliminated cascading of taxes (tax on tax).

- Created a single national market with common rates and procedures.

- Simplified compliance and improved transparency.

- Symbolized economic integration of the country.

GST Performance (2017-2025)

- Expansion of Tax Base: GST taxpayer base has grown from 66.5 lakh in 2017 to 1.51 crore in 2025, reflecting greater formalization of the economy.

- Record Revenue Growth: FY 2024-25 saw Rs. 22.08 lakh crore in gross GST collections, doubling in just four years with a CAGR of 18%.

- Economic Confidence: Rising collections and active taxpayers reflect stronger compliance, improved systems, and robust economic fundamentals. Average monthly collections have risen to Rs. 2.04 lakh crore year from Rs. 82,000 crore in 2017–18

| Indicator | 2017 | 2025 |

| Taxpayers | 66.5 lakh | 1.51 crore |

| Annual collections | Rs. 82,000 crore/month | Rs. 2.04 lakh crore/month |

| FY 2024-25 gross collection | — | Rs. 22.08 lakh crore |

| CAGR | — | 18% |

Conclusion

- The adoption of a simplified GST structure and wide-ranging rate reductions marks a new chapter in India’s tax journey. By focusing on affordability for citizens, competitiveness for businesses, and transparency in compliance, these reforms make GST not just a tax system, but a catalyst for inclusive prosperity and economic transformation. Effective from 22nd September 2025, the reforms reaffirm India’s commitment to building a simpler, fairer, and growth-oriented GST framework, ensuring both ease of living for people and ease of doing business for enterprises.

UPSC Prelims Multiple Choice Questions

Ques 1. Consider the following statements regarding the Next-Gen GST structure:

- The GST system has been simplified into only two slabs of 5% and 18%.

- The earlier 12% and 28% slabs have been removed.

- A special 40% GST rate has been introduced for luxury and sin goods.

- The new GST rates are effective from 1 January 2026.

Which of the statements given above are correct?

- 1, 2 and 3 only

- 2, 3 and 4 only

- 1 and 4 only

- 1, 2, 3 and 4

Ans 1. (1) 1, 2 and 3 only

- The new GST structure has only 5% and 18% slabs, with a 40% slab for luxury/sin goods. The reforms are effective from 22 September 2025, not 2026.

Ques 2. Consider the following goods whose GST rates were reduced to 5%:

- Cement

- Tractors

- Spectacles and corrective goggles

- Exercise books and pencils

Which of the above are correctly matched?

- 1, 2 and 3 only

- 2 and 3 only

- 1, 2, 3 and 4

- 2, 3 and 4 only

Ans 2. (4) 2, 3 and 4 only

- Tractors and spectacles reduced to 5%.

- Exercise books, pencils moved to 0%, not 5%.

- Cement reduced from 28% to 18%, not 5%.

Ques 3. Which of the following sectors witnessed GST exemption (0%) under the reforms?

- Life-saving drugs and diagnostic kits

- Individual health insurance premiums

- Pre-packaged paneer and Indian breads

- Man-made fibre textiles

Select the correct answer:

- 1, 2 and 3 only

- 1 and 3 only

- 2 and 4 only

- 1, 2, 3 and 4

Ans 3. (1) 1, 2 and 3 only

- Life-saving drugs, insurance premiums, paneer and Indian breads are GST-exempt.

- Man-made fibre reduced to 5%, not exempt.

Ques 4. Consider the following statements about compliance reforms in Next-Gen GST:

- Exporters will receive 90% upfront provisional refunds.

- AI-based risk detection will replace blanket physical inspections.

- Manual filing of returns has been made mandatory to improve accuracy.

- Registration has been simplified for small and low-risk businesses.

Which of the statements given above are correct?

- 1, 2 and 4 only

- 2 and 3 only

- 1, 3 and 4 only

- 1, 2, 3 and 4

Ans 4. (1) 1, 2 and 4 only

GST filing is becoming more digital, not manual. AI scrutiny, easier registration, and fast refunds are key features.

Ques 5. Which of the following were major problems in the pre-GST VAT era?

- Different tax rates across states

- Weak input tax credit system

- Double taxation through VAT and Service Tax

- Single national market with uniform procedures

Select the correct answer:

- 1, 2 and 3 only

- 1 and 4 only

- 2, 3 and 4 only

- 1, 2, 3 and 4

Ans 5. (1) 1, 2 and 3 only

Before GST, India had fragmented tax systems, weak ITC, and double taxation. GST created the single national market.

UPSC Mains Basic Question

Ques 1. Discuss how the Next-Generation GST reforms aim to improve ease of living for citizens and ease of doing business for enterprises in India.

Answer Framework:

- Introduction:

Introduced in 2017, the Goods and Services Tax (GST) unified India’s fragmented indirect tax system. The Next-Generation GST reforms approved in the 56th GST Council Meeting represent a further evolution, aimed at simplifying tax structures and directly benefiting both consumers and businesses.

- Body

A key feature is the simplified two-slab structure of 5% and 18%, replacing the earlier four slabs. This reduces classification disputes and enhances transparency. The reforms bring direct relief to households through reduced taxes on essential goods such as paneer, Indian breads, soaps, and food items, while consumer durables like TVs and air conditioners move from 28% to 18%.

For businesses, especially MSMEs, lower rates on cement, auto parts, textiles, handicrafts, and agricultural equipment reduce input costs. Correction of inverted duty structures in sectors like fertilizers and textiles encourages domestic value addition and exports.

The reforms also emphasize technology-driven compliance: AI-based risk detection, e-invoicing, simplified registration, and 90% upfront refunds for exporters. This reduces compliance burdens, improves cash flow, and minimizes human interface, fostering trust-based taxation.

GST exemption on health and life insurance premiums and life-saving drugs strengthens social protection. Lower taxes on hotels, gyms, and salons stimulate the service economy and employment.

- Conclusion

By combining tax rationalization with digital governance and sectoral relief, the Next-Gen GST reforms make GST more citizen-centric and business-friendly. They aim to create a virtuous cycle of lower prices, higher demand, and sustainable economic growth.

Advanced UPSC Mains Question

Ques 2. Evaluate the Next-Generation GST reforms as a continuation of India’s journey from a fragmented VAT regime to a simplified, growth-oriented tax framework. How do these reforms strengthen cooperative federalism and economic formalization?

Answer Framework:

- Introduction:

India’s pre-GST era was marked by multiple taxes, varying state rules, and cascading effects that hindered trade. GST, enabled by the 101st Constitutional Amendment (2016), created a unified market. The Next-Generation GST reforms deepen this transformation by simplifying rates and strengthening governance mechanisms.

- Body

The shift to a two-slab GST structure (5% and 18%) addresses long-standing complexities of classification and litigation. A 40% slab for luxury and sin goods maintains revenue neutrality while ensuring equity.

These reforms reinforce cooperative federalism. The GST Council, representing both Centre and States, reached consensus on rate rationalization, demonstrating collaborative fiscal decision-making. Simplified compliance and wider tax base promise sustainable state revenues through increased consumption and formalization.

Economic formalization is evident in the expansion of the taxpayer base from 66.5 lakh (2017) to 1.51 crore (2025) and record collections of Rs. 22.08 lakh crore in FY 2024-25. Digital compliance tools like AI scrutiny, e-invoicing, and faster refunds reduce evasion and enhance transparency.

Sectoral reforms-lower rates for agriculture equipment, textiles, handicrafts, MSMEs, and healthcare—correct inverted duty structures and support Make in India and export competitiveness. Exemptions for insurance and medicines link taxation with social welfare.

- Conclusion

The Next-Gen GST reforms represent not just tax rationalization but institutional maturation of India’s indirect tax system. By fostering federal cooperation, digital transparency, and economic inclusivity, they move India closer to a simplified, growth-oriented fiscal framework aligned with long-term development goals.

UPSC Interview-Based Questions

Here are 5 UPSC Interview (Personality Test) questions based on the Next-Gen GST Reforms, each followed by a 3-sentence explanation you can use while answering.

1. How do the Next-Generation GST reforms reflect a shift from tax collection to citizen welfare?

Answer:

These reforms reduce GST on essential goods, medicines, education items, and insurance, directly lowering the cost of living. They show that taxation is being used as a tool for social protection and affordability rather than merely revenue extraction. This reflects a citizen-centric approach aligned with ease of living.

2. In what way do the GST reforms strengthen cooperative federalism in India?

Answer:

The reforms were approved through consensus in the GST Council, where both Centre and States participate equally. Rate rationalization ensures sustainable revenues for states through higher demand and compliance. This demonstrates how fiscal decisions are being made through collaboration rather than unilateral action.

3. Why is the shift to a two-slab GST structure considered a major administrative reform?

Answer:

Earlier multiple slabs caused classification disputes, litigation, and compliance complexity. A two-slab system simplifies understanding for taxpayers and reduces interpretational issues. This makes GST more transparent, predictable, and easier to administer.

4. How do these reforms support MSMEs and domestic manufacturing?

Answer:

Reduced GST on inputs like cement, auto parts, textiles, handicrafts, and farm equipment lowers production costs. Correction of inverted duty structures encourages value addition within India. This directly supports Make in India and improves competitiveness of small businesses.

5. How does technology play a role in making GST more efficient under the new reforms?

Answer:

AI-based risk detection, e-invoicing, simplified digital filing, and faster refunds reduce human interface and errors. Exporters receiving 90% upfront refunds improves working capital flow. This indicates a move towards trust-based, data-driven tax governance.

Also read: 2025 Economic Reforms India’s Labour Reforms: Constitutional Status and Labour Codes United States Conducted a Military Operation “Absolute Resolve” in Venezuela