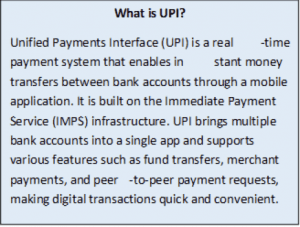

India has emerged as the global leader in fast payments, according to a recent note by the International Monetary Fund titled Growing Retail Digital Payments: The Value of Interoperability. At the heart of this transformation is the Unified Payments Interface, better known as UPI. Launched in 2016 by the National Payments Corporation of India, UPI has changed how people send and receive money in the country. It brings all your bank accounts together in one mobile app. You can transfer money instantly, pay merchants, or send funds to friends with just a few taps. Its appeal lies in its speed and ease of use. Today, UPI processes over 18 billion transactions every month in India.

This shift has taken India away from cash and card-based payments and pushed it towards a digital-first economy. Millions of individuals and small businesses now rely on UPI for safe and low-cost transactions. By making payments quick and accessible, UPI has become a powerful tool for financial inclusion.

India’s leadership in real-time payments is not an accident. It reflects years of bold digital groundwork and a vision to use technology for inclusive growth. UPI is no longer just a payment system. It is a global benchmark for innovation in public digital infrastructure.

This shift has taken India away from cash and card-based payments and pushed it towards a digital-first economy. Millions of individuals and small businesses now rely on UPI for safe and low-cost transactions. By making payments quick and accessible, UPI has become a powerful tool for financial inclusion.

India’s leadership in real-time payments is not an accident. It reflects years of bold digital groundwork and a vision to use technology for inclusive growth. UPI is no longer just a payment system. It is a global benchmark for innovation in public digital infrastructure.

Table of Contents

UPI in Figures: A Snapshot of Success

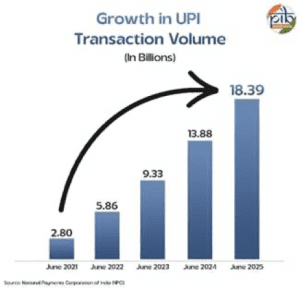

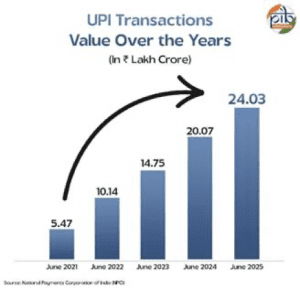

- The scale of UPI today is remarkable. In June 2025 alone, it handled over ₹24.03 lakh crore in payments. This was spread across 18.39 billion transactions. Compared to the same month last year, when there were 13.88 billion transactions, the growth is clear. There is an increase of about 32 per cent in just one year.

- The UPI system now serves 491 million individuals and 65 million merchants. It connects 675 banks on a single platform, allowing people to make payments easily without worrying about which bank they use.

- Today, UPI accounts for 85 per cent of all digital transactions in India. Its impact goes beyond national borders, powering nearly 50 per cent of global real-time digital payments.

- These figures show more than just numbers. They reflect trust, convenience and speed. Every month, more individuals and businesses choose UPI for their payments. This growing use is a strong sign that India is moving steadily towards a cashless economy.

UPI Leads the World in Real-Time Payments

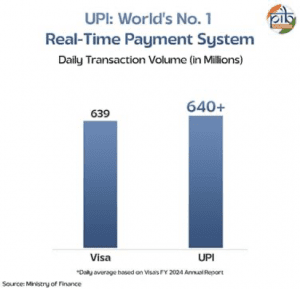

- India’s Unified Payments Interface is also now the world’s number one real-time payment system. It has surpassed Visa to take the lead in processing daily transactions. UPI handles more than 640 million transactions every day, compared to Visa’s 639 million. This scale is extraordinary, especially when you consider that UPI achieved it in just nine years.

- The UPI system now serves 491 million individuals and 65 million merchants. It connects 675 banks on a single platform, allowing people to make payments easily without worrying about which bank they use.

- Today, UPI accounts for 85 per cent of all digital transactions in India. Its impact goes beyond national borders, powering nearly 50 per cent of global real-time digital payments.

- These figures show more than just numbers. They reflect trust, convenience and speed. Every month, more individuals and businesses choose UPI for their payments. This growing use is a strong sign that India is moving steadily towards a cashless economy.

- As mentioned earlier, UPI now accounts for almost 50 per cent of transactions globally. This shows the strength of an open and interoperable system built for speed and simplicity.

- The success story does not stop at home. UPI is making its presence felt across borders. It is already live in seven countries, including the UAE, Singapore, Bhutan, Nepal, Sri Lanka, France and Mauritius. Its entry into France is a milestone because it is UPI’s first step into Europe. This allows Indians travelling or living there to pay seamlessly without the usual hassles of foreign transactions.

- India is also pushing for UPI to become a standard within the BRICS group, which now has six new member nations. If this happens, it will improve remittances, boost financial inclusion and raise India’s profile as a global tech leader in digital payments.

Interoperability and UPI

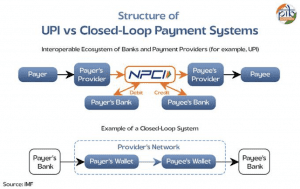

- Interoperability means different systems can work together smoothly. In payments, it allows people to send and receive money even if they use different banks or apps. For this to happen, all parts of the system must follow common rules. These include technical standards so the software works together, clear ways to interpret shared information, and agreed rights and responsibilities for everyone involved.

- Before UPI, digital payments in India were limited by closed-loop systems. A closed-loop system is one where transactions can only happen within the same platform. For example, a wallet app allowed transfers between its users but not to someone using a different wallet. Similarly, while people could use IMPS to move money between banks, they could not do so through third-party apps.

- UPI changed this. It connected banks and fintech apps through a common platform. Now, a user can pick any UPI-enabled app and pay someone using another app, without worrying about which bank they use. This is true interoperability in action.

- This openness has two big benefits. First, users have the freedom to choose their favourite app, based on trust or ease of use. Second, it creates healthy competition among providers to offer better features and security. As more apps join and improve, people get more choices and better services. This has helped UPI grow quickly and become part of everyday life for millions.

How UPI Has Changed Everyday Life

UPI has made digital payments part of daily life in India. It brings ease, speed, and safety to even the smallest transactions. Here is how it impacts ordinary people:

- Money Anytime, Anywhere: No need to stand in queues or wait for bank hours. UPI lets people send or receive money instantly, 24×7, right from their mobile phones.

- One App for All Accounts: Managing money is simpler. People can link all their bank accounts in one app instead of juggling multiple platforms.

- Safe and Quick Payments: With secure two-step authentication, payments happen in seconds without compromising safety.

- Privacy First: Users no longer share sensitive bank details. A simple UPI ID is enough, reducing risks for everyone.

- QR Code Convenience: Paying with UPI is as simple as scanning a QR code. This helps speed up transactions at shops and service points.

- No More Cash-On-Delivery Hassles: Online shopping becomes easier as UPI replaces the need to keep exact change for deliveries.

- Payments for Everything: People can now pay bills, donate, or recharge phones without stepping out of their homes.

- Help Is Just a Tap Away: Any issue with a payment can be reported directly in the app, making grievance redressal easy.

The Digital Foundation Behind UPI

- UPI’s rise as the world’s leading real-time payment system was not an accident. It is the result of years of planning and investment in digital infrastructure. India built a strong foundation that brought millions into the formal financial system, gave them secure digital identities and connected them through affordable internet. This combination created the perfect environment for UPI to grow and succeed.

Pradhan Mantri Jan Dhan Yojana

- UPI’s rise as the world’s leading real-time payment system was not an accident. It is the result of years of planning and investment in digital infrastructure. India built a strong foundation that brought millions into the formal financial system, gave them secure digital identities and connected them through affordable internet. This combination created the perfect environment for UPI to grow and succeed.

- Financial inclusion was the first big step. The Jan Dhan scheme opened bank accounts for millions who had never used formal banking before. As of July 9 2025, over 55.83 crore accounts have been created. These accounts give people direct access to government benefits and a safe place to save money.

Aadhaar and Digital Identity

- Aadhaar provided a unique identity for every resident. Each person gets a number linked to their biometrics, making authentication easy and reliable. This system ensures that benefits and services reach the right person. Since inception, over 142 crore Aadhaar cards have been generated cumulatively as on 30th June 2025, forming the backbone of many digital services, including UPI.

Connectivity and the 5G Revolution

- The next pillar was connectivity. India achieved one of the fastest 5G rollouts in the world, with 4.74 lakh base stations now active and covering almost all districts. This supports a massive mobile subscriber base of 116 crore in 2025. At the same time, internet data costs have fallen sharply from ₹308 per GB in 2014 to just ₹9.34 in 2022. With fast networks and affordable data, more people than ever can access digital services.

Conclusion

- India has emerged as the global leader in fast payments, and UPI is at the heart of this achievement. It has not only made digital transactions quick and secure but has also set a new global standard for innovation in public digital infrastructure.

- What started as a simple system to link bank accounts to mobile apps has become the backbone of a digital-first economy. Its growth is built on strong foundations of financial inclusion, digital identity and affordable connectivity. UPI’s expansion into other countries highlights its global potential. As more nations adopt this model, India’s vision of a secure, real-time, and open payment system is influencing the future of digital finance. The UPI story is far from over. It is a story of technology designed for people, and it will continue to connect lives and economies around the world.

Aspirants can easily download this article as a PDF for their UPSC Prelims, Mains and Interview preparation.

UPSC Prelims MCQ:

1. Consider the following statements regarding UPI (Unified Payments Interface):

- UPI accounts for 85% of all digital transactions in India.

- UPI is operational in over 10 countries, including France and Mauritius.

- The growth of UPI is primarily attributed to its interoperability, allowing users to transact seamlessly across different banks and payment apps.

- UPI has been the key factor in India’s transition from a cashless society to a digital-first economy.

Which of the above statements is/are correct?

(a) 1, 3, and 4 only

(b) 2, 3, and 4 only

(c) 1 and 3 only

(d) 1, 2, and 3 only

Correct answer: (a)

Explanation:

- Statement 1: UPI accounts for 85% of digital transactions in India, which is correct, according to the passage.

- Statement 2: UPI is operational in seven countries, not over 10, so this statement is incorrect.

- Statement 3: UPI’s interoperability is a crucial feature that allows seamless transactions across different platforms, which is true.

- Statement 4: UPI has indeed been a key factor in India’s transition to a digital-first economy, facilitating cashless transactions and financial inclusion.

2. Which of the following statements about UPI’s role in financial inclusion is/are true?

- UPI has made digital payments quick, secure, and accessible to millions, including individuals and small businesses in rural areas.

- UPI has become a tool for financial exclusion by limiting access to only those who possess smartphones.

- UPI’s interoperability has led to widespread use across different platforms and banking apps, enhancing access to financial services.

- UPI has played a role in improving women’s financial empowerment, especially in rural and underserved communities.

Select the correct answer using the code given below:

(a) 1, 3, and 4 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 3 and 4 only

Correct answer: (a)

Explanation:

- Statement 1: UPI’s quick, secure, and accessible nature has indeed improved financial inclusion for individuals and businesses in rural areas.

- Statement 2: This statement is incorrect as UPI has facilitated financial inclusion, even for people with low literacy and access to basic smartphones.

- Statement 3: UPI’s interoperability allows seamless transactions between different apps and banks, which expands access to financial services.

- Statement 4: UPI has indeed empowered women in rural and underserved areas by providing financial independence and easy access to digital services.

3. Consider the following statements about the growth of UPI:

- It was launched in 2016.

- It was launched by the National Payments Corporation of India (NPCI) to simplify digital payments and enhance financial inclusion in Indi.

Which of the above statements is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Correct answer: (c)

Explanation:

- Statement 1: The Unified Payments Interface (UPI), launched in 2016, is the core innovation that has propelled India to become a global leader in fast payments. It has revolutionized the way people send and receive money in India.

- Statement 2: UPI was launched in 2016 by the National Payments Corporation of India (NPCI) to simplify digital payments and enhance financial inclusion in India.

4. Which of the following statements about UPI’s interoperability is/are correct?

- UPI operates in a closed-loop system, where users can only make transactions within the same platform.

- UPI’s interoperability allows users to send money across different banking apps, making payments simple and accessible.

- UPI’s open system promotes competition among service providers, ensuring better features and security for users.

- UPI’s success has been limited to India, and its adoption in other countries is still in its nascent stages.

Select the correct answer using the code given below:

(a) 2 and 3 only

(b) 1 and 2 only

(c) 2, 3, and 4 only

(d) 1, 2, and 3 only

Correct answer: (a)

Explanation:

- Statement 1: This is incorrect. UPI operates in an open, interoperable system, not a closed-loop system.

- Statement 2: UPI’s interoperability indeed allows users to make payments across different banking apps, making it easier for people to transact.

- Statement 3: UPI’s openness creates healthy competition among providers, leading to better features and security for users.

- Statement 4: UPI has made its mark globally, expanding to seven countries (including the UAE, Singapore, France), so this statement is incorrect.

5. Which of the following countries is UPI NOT currently operational in?

- UAE

- Singapore

- Germany

- France

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 and 3 only

(c) 3 only

(d) 3 and 4 only

Correct answer: (c)

Explanation:

UPI is operational in UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius, but it is not operational in Germany. Therefore, Germany is the correct answer.

UPSC Mains Basic Questions:

1. What is the Unified Payments Interface (UPI)? Discuss its significance in India’s transition to a digital economy. (150 words)

Explanation:

This question tests the candidate’s ability to define UPI and assess its importance in India’s digital payment transformation.

Introduction:

- The Unified Payments Interface (UPI) is a revolutionary digital payment system introduced in India in 2016 by the National Payments Corporation of India (NPCI). UPI allows users to link multiple bank accounts to a single mobile application, enabling instant money transfers, bill payments, and merchant transactions 24/7.

Body:

- UPI’s significance lies in its speed, convenience, and accessibility. It enables instant money transfers between different bank accounts with just a few taps on a smartphone, eliminating the need for physical cash or card-based payments. UPI is also interoperable, meaning it works across different banks and payment platforms, providing users with the flexibility to choose their preferred apps.

- For example, a person can transfer funds using UPI from PhonePe to a recipient using Google Pay, regardless of their bank or app. UPI’s QR code system further enhances its use in daily transactions, from paying bills to shopping at local stores.

Conclusion:

- UPI has played a crucial role in India’s shift to a digital-first economy. It has made digital payments easy, safe, and widely accessible, fostering financial inclusion by providing millions of previously unbanked individuals with access to digital financial services. As a result, UPI has become an indispensable part of India’s payment infrastructure, driving the country towards becoming a global leader in digital payments.

2. How has India’s digital infrastructure, including UPI, Aadhaar, and the Jan Dhan Yojana, contributed to financial inclusion in the country? (150 words)

Explanation:

This question focuses on the role of India’s digital infrastructure in fostering financial inclusion.

Introduction:

India’s digital infrastructure, including UPI, Aadhaar, and the Jan Dhan Yojana, has been instrumental in driving financial inclusion. These initiatives have provided millions of previously unbanked individuals with access to financial services, improving economic opportunities for people across the country.

Body:

UPI has transformed the way Indians make payments by enabling instant, cashless transactions using smartphones. It has brought digital payments to the masses, allowing individuals, including those in rural areas, to send money, pay bills, and make purchases easily. For example, a person in a rural area can pay for groceries through UPI without needing cash or cards.

Aadhaar, India’s unique identification system, has provided a digital identity to over 1.4 billion people. Aadhaar’s biometric authentication ensures secure access to banking services and government benefits. This has greatly improved benefit delivery, especially to marginalized communities.

The Jan Dhan Yojana has played a pivotal role by providing zero-balance bank accounts to millions. By opening over 55 crore accounts, it has ensured direct access to financial products, savings, and government schemes.

Conclusion:

Together, these initiatives have bridged the financial gap, empowering the underprivileged with digital financial tools. India’s digital infrastructure has been a driving force for financial inclusion, enabling economic growth and providing people with opportunities to participate in the formal financial system.

Advanced UPSC Mains Questions –

1. Discuss the role of the Unified Payments Interface (UPI) in transforming India’s digital payment landscape. How has UPI contributed to financial inclusion and economic growth? (250 words)

Explanation:

This question requires the candidate to critically assess the impact of UPI on India’s digital economy and its contribution to financial inclusion. The answer should discuss the following points:

- Introduction to UPI: UPI, launched in 2016 by the National Payments Corporation of India (NPCI), is the cornerstone of India’s digital payments system.

- Transformation in Payments: UPI has shifted India from cash-based and card-based payments to a digital-first economy, with over 18 billion transactions processed every month.

- Financial Inclusion: UPI has empowered millions, especially small businesses and individuals in rural areas, by providing access to safe, quick, and low-cost digital transactions. UPI’s interoperability allows people to link accounts across banks, which democratizes access to financial services.

- Key Features of UPI: The system offers 24/7 instant payments, security through two-step authentication, and privacy protection. The QR code system has simplified payments at retail locations.

- Global Impact: UPI’s success is evident in India’s leadership in real-time payments, processing 50% of global real-time transactions. UPI has now expanded to countries like UAE, Singapore, and France, making India a global leader in digital payments.

- Conclusion: UPI’s development is a visionary step toward creating a cashless society while fostering inclusive growth and contributing to India’s broader economic development.

2. Analyze the impact of India’s digital infrastructure, including UPI, Aadhaar, and the Jan Dhan Yojana, on the country’s financial inclusion and digital economy. How have these initiatives contributed to India’s leadership in real-time payments? (250 words)

Explanation:

This question requires the candidate to discuss how India’s digital infrastructure has collectively enhanced financial inclusion and supported the nation’s leadership in digital payments. The answer should cover:

- Introduction to Digital Infrastructure: The question should start with an overview of India’s digital infrastructure, which includes UPI, Aadhaar, and the Jan Dhan Yojana, all of which play key roles in shaping India’s digital economy.

- UPI’s Role in Real-Time Payments: UPI has made digital payments quick, secure, and universally accessible, allowing India to lead in real-time digital transactions. As of June 2025, UPI processed ₹24.03 lakh crore in payments, demonstrating its success.

- Aadhaar and Digital Identity: Aadhaar, India’s unique identification system, has provided a secure way to verify identities, ensuring easy access to services. Over 142 crore Aadhaar cards have been generated, supporting digital financial inclusion.

- Jan Dhan Yojana and Financial Inclusion: The Jan Dhan Yojana has been instrumental in opening over 55 crore bank accounts, many for individuals who had previously lacked access to formal banking services. This scheme laid the groundwork for digital banking and financial inclusion.

- Connectivity and 5G Revolution: India’s fast 5G rollout and affordable internet (data costs dropped from ₹308 per GB in 2014 to ₹9.34 in 2022) have made digital services accessible to a broader population.

- Conclusion: Together, these initiatives have enabled India to build a strong digital-first economy, making it the global leader in real-time payments and a model for financial inclusion and technological innovation.

UPSC Interview-Based Questions

1. How does India’s growing digital payments infrastructure, like UPI, impact the country’s economy and financial inclusion?

Explanation:

This question tests the candidate’s understanding of how digital payment systems influence economic development and financial inclusion. The interviewer wants to assess the candidate’s ability to explain how innovations like UPI are not just technological tools, but also drivers of economic empowerment for marginalized sections of society. A strong answer would discuss how UPI helps reduce transaction costs, increase accessibility, and promote the digital economy. It can also touch on the relationship between digital payments and financial literacy and how UPI bridges the gap between rural and urban India.

My Answer: India’s growing digital payments infrastructure, particularly UPI, has significantly impacted the country’s economy by driving cashless transactions, making payments quicker, safer, and more efficient. It has enhanced financial inclusion by providing millions of people, especially in rural areas, access to digital banking and payment services. UPI’s interoperability allows people to easily transfer funds across different banks, facilitating seamless transactions for individuals and businesses. As a result, it has promoted a digital-first economy, reduced reliance on cash, and increased participation in formal financial systems. The widespread adoption of UPI has also empowered small businesses, encouraging economic growth and supporting the government’s financial inclusion goals.

2. The digital divide still exists in India, especially in rural areas. How can the government ensure inclusive digital growth across all sections of society?

Explanation:

This question tests the candidate’s awareness of challenges and solutions related to inclusive growth. The interviewer is looking for solutions that focus on ensuring equitable access to digital infrastructure and services. A good answer could highlight initiatives such as improving internet penetration, providing digital literacy programs, and increasing awareness about government digital platforms. Additionally, the answer can emphasize the need for financial products tailored to rural needs, ensuring that the digital revolution does not leave anyone behind.

My Answer: To ensure inclusive digital growth, the government must focus on improving internet connectivity in rural areas through 5G infrastructure and affordable data plans. It should expand digital literacy programs to teach essential skills, especially in remote regions. Government initiatives like Digital India and PMGDISHA can be scaled up to ensure wider access. Collaboration with private companies can improve last-mile connectivity and create localized solutions. Lastly, creating financial incentives for businesses to adopt digital payment systems will further promote digital inclusion.

3. How can India balance technological advancements like UPI with the need to safeguard data privacy and security?

Explanation:

The interviewer wants to test the candidate’s understanding of data privacy and security in the context of fast-developing digital technologies. This question is important because digital systems like UPI involve sensitive personal and financial data. The candidate’s response should include steps such as strengthening cybersecurity frameworks, ensuring regulations on data protection (like the Personal Data Protection Bill), and promoting awareness among citizens about the safe use of digital platforms. The answer can also touch upon the role of encryption and multi-factor authentication in securing digital transactions.

My Answer: India’s growing digital payments infrastructure, particularly UPI, has significantly boosted the economy by enabling instant, low-cost transactions across the country. It has facilitated financial inclusion by providing easy access to banking services for millions, including those in rural areas. UPI’s interoperability across banks has reduced reliance on cash and cards, driving a cashless economy. By promoting safe and accessible digital payments, UPI supports small businesses, empowers individuals, and increases economic participation. As a result, it has positioned India as a leader in global real-time payments.

4. In your opinion, what role does financial literacy play in India’s journey towards a cashless society, and how can it be improved?

Explanation:

This question examines the candidate’s understanding of financial literacy in the context of a cashless society. The interviewer seeks an insightful answer about how financial literacy can enable people to use digital payment systems like UPI, thus contributing to India’s cashless economy. The candidate can mention strategies such as introducing financial literacy programs in schools, promoting awareness about digital wallets, and using public media campaigns to encourage people to adopt digital payments securely. The answer should highlight the need for targeted outreach to rural areas, where digital literacy is often lower.

My Answer: Financial literacy is crucial in India’s transition to a cashless society as it empowers individuals to understand and use digital payment systems safely and effectively. It enables people to make informed decisions about digital banking, security, and financial tools. To improve financial literacy, initiatives like school curricula, public awareness campaigns, and community workshops can be introduced. Digital platforms and mobile apps can also be leveraged to teach financial concepts in simple terms. Enhancing financial literacy ensures that no one is left behind in the shift towards a digital economy.

5. With UPI’s success, what other sectors do you think can benefit from such technological integration in India?

Explanation:

This question tests the candidate’s ability to identify sectors that can leverage digital technologies. The candidate should think beyond financial payments and discuss how UPI’s model of interoperability and efficiency can be applied in other sectors like education, healthcare, agriculture, and e-governance. For example, in education, digital platforms can enable fee payments, access to learning resources, and scholarships. In healthcare, UPI can facilitate digital consultations, payment for medical services, and distribution of subsidies. The answer should reflect a broad understanding of technology’s potential for inclusive growth.

My Answer: With UPI’s success, several other sectors in India can benefit from similar technological integration:

- Healthcare: Digital payment systems can streamline medical bill payments, enable telemedicine consultations, and facilitate insurance claim processing, improving accessibility and reducing administrative costs.

- Education: UPI can enable easy fee payments, online courses, and scholarship disbursements, making education more accessible, especially in remote areas.

- Agriculture: Technology like UPI can assist in digital payments for farmers, subsidy distribution, and market linkages, reducing middlemen and increasing farmer incomes.

- Government Services: UPI can facilitate real-time disbursement of subsidies, taxes, and welfare benefits, ensuring transparency and reducing leakages.

- E-commerce: UPI can drive seamless payments for both buyers and sellers, promoting the growth of online retail and enhancing consumer experience.

These integrations would further streamline operations, improve accessibility, and foster inclusive growth across multiple sectors in India.

Suggested Readings

Indus Valley Civilisation Battle of Plassey President of India Article 21