CBSE Class 12 Accounts, Cash flow statement

NOTES

CHAPTER 14: Cash Flow Statement

A Cash flow statement shows inflow and outflow of cash and cash equivalents from various activities of a company during a specific period. The primary objective of cash flow statement is to provide useful information about cash flows (inflows and outflows) of an enterprise during a particular period under various heads, i.e., operating activities, investing activities and financing activities

Benefits of Cash Flow Statement

- A cash flow statement when used along with other financial statements provides information that enables users to evaluate changes in net assets of an enterprise

- Cash flow information is useful in assessing the ability of the enterprise to generate cash and cash equivalents and enables users to develop models to assess and compare the present value of the future cash flows of different enterprise

- It also enhances the comparability of the reporting of operating performance by different enterprises because it eliminates the effects of using different accounting treatments for the same transactions and events.

- Cash from Operating Activities

Operating activities are the activities that constitute the primary or main activities of an enterprise. Cash flows from operating activities are primarily derived from the main activities of the enterprise. They generally result from the transactions and other events that enter into the determination of net profit or loss. Examples of cash flows from operating activities are:

Cash Inflows from operating activities- Cash receipts from sale of goods and the rendering of services.

- Cash receipts from royalties, fees, commissions and other revenue.

Cash Outflows from operating activities

- Cash payments to suppliers for goods and services.

- Cash payments to and on behalf of the employees.

- Cash payments to an insurance enterprise for premiums and claims, annuities, and other policy benefits.

- Cash payments of income taxes unless they can be specifically identified with financing and investing activities.

- Cash from Investing Activities

Investing activities are the acquisition and disposal of long-term assets and other investments not included in cash equivalents. Investing activities relate to purchase and sale of long-term assets or fixed assets such as machinery, furniture, land and building, etc.

Cash Outflows from investing activities- Cash payments to acquire fixed assets including intangibles and capitalised research and development.

- Cash payments to acquire shares, warrants or debt instruments of other enterprises other than the instruments those held for trading purposes.

- Cash advances and loans made to third party (other than advances and loans made by a financial enterprise wherein it is operating activities).

- Cash receipt from disposal of fixed assets including intangibles.

- Receipt from the repayment of advances or loans made to third parties (except in case of financial enterprise).

- Cash receipt from disposal of shares, warrants or debt instruments of other enterprises except those held for trading purposes.

- Interest received in cash from loans and advances.

- Dividend received from investments in other enterprises.

- Cash from Financing Activities

Financing activities relate to long-term funds or capital of an enterprise, e.g., cash proceeds from issue of equity shares, debentures, raising long-term bank loans, repayment of bank loan, etc.

Cash Inflows from financing activities- Cash proceeds from issuing shares (equity or/and preference)

- Cash proceeds from issuing debentures, loans, bonds and other short/ long-term borrowings.

- Cash repayments of amounts borrowed.

- Interest paid on debentures and long-term loans and advances.

- Dividends paid on equity and preference capital.

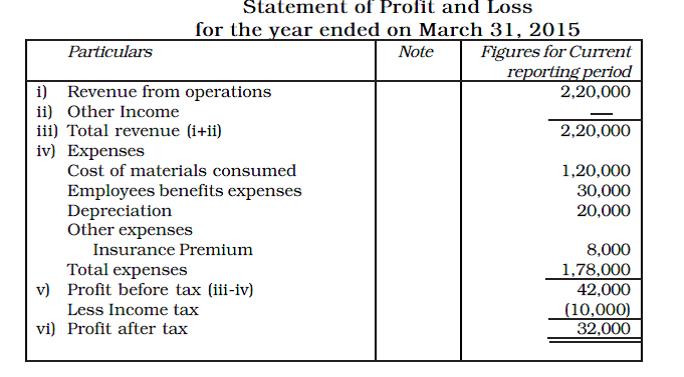

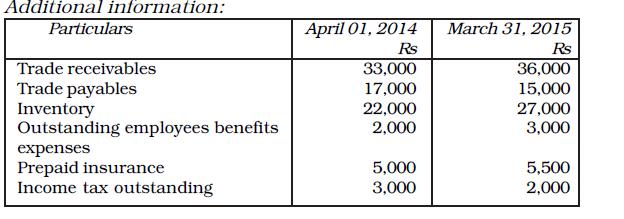

Example 1:

From the following information, calculate cash flow from operating activities using direct method.

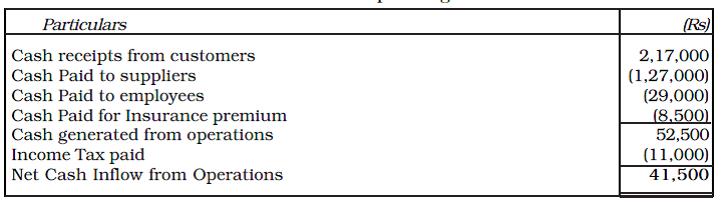

Solution:

Cash flow from operating Activities

Working Notes:

- Cash Receipts from Customers is calculated as under: Cash Receipts from Customers = Revenue from Operations + Trade Receivables in the beginning − Trade Receivables in the end

- Purchases = Cost of Revenue from Operations − Opening Inventory + Closing Inventory

= Rs 1, 20,000 − Rs 22,000 + Rs 27,000 = Rs 1,25,000 - Cash payment to suppliers = Purchases + Trade Payables in the beginning − Trade Payables in the end

= Rs 1,25,000 + Rs 17,000 − Rs 15,000 = Rs 1,27,000 - Cash Paid to Employees = Rs 30,000 + Rs 2,000 − Rs 3,000 = Rs 29,000

- Cash Paid for Insurance Premium = Rs 8,000 − Rs 5,000 + Rs 5,500 = Rs 8,500

- Income Tax Paid = Rs 10,000 + Rs 3,000 − Rs 2,000 = Rs 11,000

= Rs 2, 20,000 + Rs 33,000 − Rs 36,000

= Rs 2, 17,000

Example 2:

From the following calculate cash flow from investing activities:-

| Particulars | Closing balance | Opening balance |

|---|---|---|

|

Machinery (at cost) Accumulated Depreciation Patents |

4,20,000 1,10,000 1,60,000 |

4,00,000 1,00,000 2,80,000 |

Additional Information:

- During the year a machine costing Rs. 40,000 with its accumulated depreciation of Rs. 24,000 was sold for Rs. 20,000.

- Patents written off were Rs. 40,000 and some patents were sold at a profit of Rs. 20,000.

Solution:

Cash flow from Investing Activities:-

| Particulars | Rs. |

|---|---|

|

Proceeds from sale of machinery Payment for purchase of machinery (WN1) Proceeds from sale of patents (WN2) |

20,000 (60,000) 1,00,000 |

|

Cash flow from Investing activities |

60,000 |

Working notes:

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To bal b/d To gain(profit) on sale of a machinery To bank A/c (purchase) (bal fig) |

4,00,000 4,000 60,000 |

By bank A/c (sale of machinery) By accumulated depreciation A/c By bal c/d |

20,000 24,000 4,20,000 |

|

|

4,64,000 |

|

4,64,000 |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To bal b/d To gain(profit) on sale of patent |

2,80,000 20,000 |

By bank A/c (sale) By ammortisation A/c By bal c/d |

1,00,000 40,000 1,60,000 |

|

|

3,00,000 |

|

3,00,000 |

|

(i) Cash flows from operating Activities a) Net profit before tax and extraordinary items Adjustments for Non-cash and non-operating items. b) Items to be added Depreciation Goodwill patents Interest on borrowings Loss on sale of assets Increase in provision of debts c) Less: Interest income/received Dividend income received Rental income received Profit on sale of fixed asset d) Operating profits before working capital changes (A + B − C) e) Decrease in current assets and increase in current liabilities f) Less : Increase in current assets and decrease in current liabilities g) Cash generated from operations (D + E − F) h) Less : Income tax paid (Net tax refund received) i) Cash flow from before extraordinary items extraordinary items (+/−) j) Net cash from operating activities (ii) Cash flow from investing activities Add: − Proceeds from sale of fixed assets Proceeds from sale of investments Proceeds from sale of intangible assets Interest and dividend received Less: – Rent income Purchase of fixed assets Purchase of investment Purchase of intangible assets like goodwill Advanced extraordinary items (+/−) Net cash from (or used in) investing activities (iii) Cash flows from financing activities Add: Proceeds from issue of shares and debentures Proceeds from other long term borrowings Less : Final dividend fund Interim dividend fund Interest on debentures and loans paid Repayment of loans Redemption of debenture & preference shares Adjust extraordinary items (+/−) Net cash from (or used in) financing activities (iv) Net increase/Decrease in cash and cash & equivalent (i + ii + iii) (v) Add: cash and cash equivalents in the beginning of the year − cash in hand cash at bank overdraft short term deposit marketable securities (vi) cash and cash equivalents in the end of the year cash in hand cash at Bank (by bank overdraft) short term deposits |

|

Example 3:

From the following information. Calculate the Cash from financing activities:

| Particulars | 31.12.2006 | 31.12.2007 |

|---|---|---|

| Equity share capital | 4,00,000 | 5,00,000 |

| 10% debentures | 1,50,000 | 100,000 |

| Securities premium | 40,000 | 50,000 |

Additional Information: Interest paid on debentures Rs. 10,000.

Solution:

| Particulars | Rs |

|---|---|

| Cash proceeds from the issue of shares 110000 (Including premium) | |

| Interest paid on debenture | 10,000 |

| Redemption of debenture | 50,000 |

| 50,000 |

Example 4:

From the following Balance Sheet of Dreams Converge Ltd as at 31.3.2018 and 31.3.2017; Calculate Cash from operating activities. Showing your workings clearly

| PARTICULARS | NOTE NO. | 31st March 2018 | 31st March 2017 |

|---|---|---|---|

|

I. EQUITY AND LIABILITY: 1. Shareholder’s Fund: a. Share Capital b. Reserve and Surplus 2. Non-Current Liabilities: Long Term Borrowings 3. Current Liabilities: a. Trade Payables b. Short term Provisions (Provision for tax) |

|

7,00,000 3,50,000 50,000 1,22,000 50,000 |

5,00,000 2,00,000 1,00,000 1,05,000 30,000 |

|

Total |

|

12,72,000 |

9,35,000 |

|

II. ASSETS: 1. Non-Current Assets: a. Fixed Assets: i. Tangible Assets ii. Intangible Assets b. Non-current Investments 2. Current Assets: a. Inventory b. Trade Receivable c. Cash and Cash Equivalents |

|

5,00,000 95,000 1,00,000 1,30,000 1,47,000 3,00,000 |

5,00,000 1,00,000 Nil 55,000 80,000 2,00,000 |

|

Total |

|

12,72,000 |

9,35,000 |

NOTES

| NOTE Number | Particulars | 31.3.2018 | 31.3.2017 |

|---|---|---|---|

| 1. |

Tangible Assets: Machinery Accumulated depreciation |

2,80,000 (1,00,000) |

2,00,000 (80,000) |

|

|

|

1,80,000 |

1,20,000 |

|

|

Equipment |

3,20,000 |

3,80,000 |

| 2. |

Intangible Assets : Goodwill |

95,000 |

1,00,000 |

Machinery of the book value of 80,000 (accumulated depreciation 20,000) was sold at a loss of 18,000

Solution:

| Particulars | Amount | Amount |

|---|---|---|

|

I Cash from Operating Activity Net Profit Before Tax Profit during the year Add transfer to Reserve Add: Non Cash Non-Operating Expenses Depreciation provided Loss on Sale of Assets Goodwill Amortized Less Non-Operating Income Operating Profit before Working Capital Add Increase in Trade Payable Less : Increase in Inventory Increase in Trade Receivable Cash From Operating Activities before Tax Less Tax Paid Cash From Operating Activities After tax |

1,50,000 50,000 40,000 18,000 5,000 -- 17,000 (75,000) (67,000) |

2,00,000 63,000 2,63,000 17,000 2,80,000 (1,42,000) 1,38,000 (30,000) 1,08,000 |

| Particulars | Amount | Particulars | Amount |

|---|---|---|---|

|

To Balance b/d To Bank A/c (Purchases) |

2,00,000 1,60,000 |

By Accumulated Depreciation By Loss on sale of Fixed Asset By Bank A/c By Balance c/d |

20,000 18,000 42,000 2,80,000 |

|

|

3,60,000 |

|

3,60,000 |

| Particulars | Amount | Particulars | Amount |

|---|---|---|---|

|

To Machinery A/c To Balance c/d |

20,000 1,00,000 |

By balance b/d By Statement of Profit and loss account |

80,000 40,000 |

|

|

1,20,000 |

|

1,20,000 |